Storm Damage

When the Storms Blow in… Castro is ready with the right solution

When your building is hit by a storm, the last thing you want to do is frantically and haphazardly apply “Band-Aid” solutions on readily apparent leaks. Obviously, the leaks need to be stopped; but more importantly, your building needs to be fully assessed for damage—both seen and unseen—so the best short-term AND long-term solution can be implemented.

At Castro Roofing, we’ve perfected the art of damage detection and repair. We go far beyond the usual visual assessments and quick-fix remedies applied by many roofers. Our process is comprehensive; it’s designed to sniff out the most difficult-to-find hidden damage, provide you with a detailed assessment, and fix everything with the highest level of quality available.

Here’s an overview of our famous 5-Step Storm Damage Blueprint process:

Step 1: Blueprint – Getting A Handle On The Damage

- Includes visual inspection, photo documentation, and video documentation.

- The entire premises is evaluated, not just the roof in question.

- The severity of the damage is ascertained; if not severe, no action will be taken (we don’t work on bogus claims).

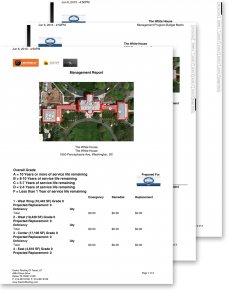

- All information (video, photo, report) is uploaded into the password-protected client portal.

Step 2: Detailed Assessment – Proving The Extent Of The Damage

- Damage has to be proven to the insurance company; frequently, the insurance auditor will find less damage than is actually present.

- We gather forensic evidence that goes far beyond simple visual inspection; larger-scale damage is often detected.

- Our team of experts—engineers, consultants, roofing experts—will build a forensic case you or your insurance representative may present to the insurance company to prove the damage and amount of money required to fix it.

- We make sure the adjuster knows EXACTLY what to look for—everything is documented.

Step 3: Scope Of Work – Making Sure The Insurance Company Is On Board

- Once we present our forensic on cost data information to you, you or your insurance representative may present it to the insurance company to get the insurance company to agree on a detailed scope of work.

- Other contractors “leave money on the table” by not understanding current building code requirements. We will research code requirement and let you know if your current system is to code. If the building is not reconstructed to current building code, this may lead to other problem.

- Once agreed, we move on to Reconstruction phase…

Step 4: Reconstruction – Fixing The Problem Right The First Time

- Castro Roofing is your General Contractor; we handle ALL aspects of the reconstruction phase, including bringing in the right engineers, architects, and subcontractors. You don’t need to worry about the tedious details of the reconstruction phase.

- Most roofing companies simply “build the roof.” We handle the entire project. You aren’t left to coordinate the complexity and coordination of subcontractors, regulatory requirements, suppliers, and many other details.

- We don’t just haphazardly bring in the lowest bidders; we only use trusted professionals that we KNOW can do the job right. We leave NOTHING to chance.

- We keep you informed every step of the way via our online “Four Yours Eyes Only” password protected web portal.

- All project photographs, videos, safety inspections, construction inspections, and warranty documentation are kept in your online web portal for easy access and review in the future. This gives a new meaning to “paper trail.”

Step 5: Post-Construction – We’re With You FOREVER

- Most roofers never see their client again once the repair or replacement is complete.

- To prolong your roof, we provide preventative maintenance FOR LIFE.

- We conduct frequent inspections and log all information (including photos, videos, etc.) on your online web portal.

- Everything is always documented and available at a moment’s notice; this gives you the data you need to budget for future repairs and make decisions about replacing roofs. You’ll never be caught off guard.

Getting Started with Your Storm Damage Strategy

Storm Damage Blueprint is five advance steps to instantly increase 30-50 percent results.

- Blueprint Introduction

- Assess Damage

- Prove Damage

- Re-Construction

- Post Construction

Getting started with the BLUEPRINT INTRODUCTION experience

The Blueprint Introduction is the first phase of the Storm Hawks Damage Blueprint. In this phase, the Storm Hawks Unit Responder performs an initial free consultation, if we feel we have a good fit, the Unit Responder will initiate a free Forensic Damage Assessment of some of your buildings. After video and photo documenting the potential damage, the Unit Responder will report his findings to the building owner and his executive team during our 7 O’s Experience presentation. During this presentation, the Unit Responder will cover 7 points:

- Overview – During the Overview phase, we will show you the damage using videos and photos taking during our initial damage assessment.

- Objectives – Castro Roofing wants to better understand your goals and what will make this a successful project from your perspective. We will also discuss Castro Roofing’s goals for the insurance claim.

- Obsolescence – What could hinder our success or block the achievement of our Objectives… possibly even things that have been attempted already without the desired results.

- Opportunity – It’s all about proving damage and working together. We provide technical information to support the insurance claim:

- CAD files

- Core assistance per ASTM

- Photo and video documentation

- Thermal mapping

- Roof access

- Industry standard pricing structure

- Objections – What objections or concerns do you have related to the Storm Damage Claim?

- Zero Hour – This is a military term that represents the time in which an event is scheduled to begin. Let’s talk about the time frame for the work you want done, the time it will take, and a time that is comfortable for you.

- Organize – And lastly, we will draw out an initial plan, if appropriate, to organize our resources and add any other team members we need in order to quickly, yet efficiently resolve our objectives successfully and completely.

The last phase for the Blueprint Introduction is the Green Light Agreement. If all parties agree to work as a team, Castro Roofing will provide our Agreement form to start the next phases of the process.

Assess Storm Damage

One of the most important phases of an insurance claim is the building owner’s ability to prove storm damage. Without proper storm damage assessment, it becomes extremely difficult, if not impossible to build an iron clad case.

Storm Hawks performs the following assessment to help you or your insurance expert build your case for the insurance company:

- Inventory all properties

- Detailed forensic investigation

- Core sample and material testing

- Fly-over video and photo documentation

- Storm Hawks Diagnostic Report

- CAD technical drawings

- Curtain Damage Audit

- X-Vision Thermal Mapping and Surveying

- Technical compliance

- International Building Code compliance

- Other assessments as needed to build the case

Storm Damage Case Study Video #1 – Actual footage of JPS in Louisiana.

Insurance company only wanted pay to coat over the existing roof.

Storm Damage Case Study – Actual footage of Kennedale ISD in Texas.

Insurance company originally denied claim.

Prove Storm Damage

When a commercial business is damaged by a covered peril (windstorm, fire, hail, etc.), the building owner will normally call his insurance agent or insurance company to file a claim.

The insurance company will then send either a staff adjuster or an independent adjuster to estimate the damage and issue a check to the policy holder. From this typical example, you would conclude that the insurance company has the burden of showing what is and is not covered under the insurance policy. However, this is not the case in Texas and some other states.

A little known case in Texas, David Lewis Builders, Inc. v. Mid-Continent Cas. Co., No. 09-21, 2010 WL 1286544 (N.D. Tex. April 1, 2010), explains the burdens of proof in Texas for insurance claims.

In the opinion, the court stated that, “Texas law places the burden to prove the existence of insurance coverage under an insurance policy on the party claiming coverage.” In other words, for a policyholder to obtain coverage under the policy, the policyholder, not the insurance company, must prove that certain damage is covered under the policy.

Assuming that the policyholder has an iron clad case demonstrating that certain damage should be covered under the policy, what is the next step? The Court in David Lewis Builders, Inc. added: “[a]n insurer has the burden to prove the applicability of a policy exclusion.” If the insurance carrier can show that an exclusion to the policy applies, “[t]he insured has the burden to prove the applicability of an exception to that exclusion.”

In Texas, the courts have decided that there are three burdens of proof that both sides must prove with respect to an insurance claim:

- The policyholder has the responsibility to prove the storm damage should be covered under the insurance policy;

- The insurance company must show that an exclusion applies and will not have to pay the claim; and

- The policyholder must show that an exception to the exclusion applies.

If you are keeping count, the policyholder has two burdens of proof to demonstrate, whereas the insurance company only has one. So the next time your insurance company sends one of its adjusters to estimate the damage to your business, it would be good to keep in mind the different burdens of proof each party must bear under Texas law.

We thought you might find this article informative. It has been our experience that a policyholder who understands and acts according to the information discussed in the article above greatly increases their chance of obtaining a fair and just insurance settlement.

*The information on this report is for informational purpose only and not for the purpose of providing legal advice or insurance coverage advice. You should contact your attorney or licensed public adjuster to obtain advice with respect to any particular issue or problem. Information is not the same as legal advice. Castro Roofing is neither an attorney nor a public adjuster and is not license to provide legal or insurance coverage advice.

Storm Damage Case Study Video #2 – Actual footage of JPS in Louisiana.

Insurance company only wanted pay to coat over the existing roof.

How Does Snow Storm Damage Commercial Roof Systems

Re-Construction

Every year the Better Business Bureau receives over 2,000,000 inquiries regarding the trustworthiness of Roofing Companies…

That’s more than any other industry!

If the work is not perform to the highest craftsmanship methods, all the work that was done during the previous three steps would be almost worthless.

Here is our 10-Point Promise:

- General Contractor service

- LongLife 10-year Labor Warranty (best in the industry)

- Cloud storage of all project documents

- Weekly Project Status Report

- 20-year roof manufacturer warranty

- Daily On-line Project Management (OPM) reports email to you

- Statutory Performance and Payment Bonds

- Advance communication technology

- Design Built Assistance

- Statutory insurance requirements

Post Construction Service – Continues service after the project is completed

This is the final phase of the Storm Hawks Storm Damage Blueprint. We consider this phase the one that holds Castro Roofing accountable. It is the most important phase, the “after we are done” phase. This is critical because people worry about contractors picking-up shop and leaving never to heard from again. Especially when it comes down to honoring warranties or continuing maintenance programs.

The reality is that once we become a team, we will never leave your side.

Storm Hawks brings two comprehensive programs after all work is completed providing 100% guaranteed coverage as your partner in maintaining building quality and safety. We like to refer to this as delivering peace of mind!

- LOOKOUT ™ Roof Monitoring Program – Once the replacement of the roof is completed, we continue our services by performing annual preventative roof inspections to extend the life of your roof, we maintain an online database of how the roof is performing and identify and resolve any issues that require attention before it become a major problem. Think of it as a regular oil change and tire rotation for your car. All findings regarding the status of the roof are uploaded to your online web portal that you may access at any time. This information is critical for compliance with the roofing manufacture warranty requirements as well the insurance company requirements set forth in most insurance policies. In essence, we provide an annual roof inspections and log all information electronically inside your LOOKOUT™ portal.

This keeps you from ever having to budget for roof repairs or maintenance because of our LongLife warranty.

- First Watch Storm Readiness Program – You will always be a priority candidate for First Watch Storm Readiness Program. Where upon any storm may impact your geographic location, we will have after touch down a Storm Hawks Unit Responder on the ground to validate safety and verify secure storm survivor and provide immediate response for necessary storm damage repairs within hours after storm touching down.

We are the only organization in the country to provide private emergency response to mitigate all damages, downtime and possible repairs to; as well as expedite any future storm damage recovery, should it be necessary due to weather.

The Storm Hawks will be your guardian angel from this moment forward.